Long term wealth creation is obtained by holding onto the winners– well established niche/branded plays and deserting the losers–small/unbranded companies with low/no growth profile.

Our Investment Advisory Services endeavour to create sustainable wealth for its HNI clients through direct investments into equity markets on a medium to long term basis. We believe that investing directly into equities in large-cap stocks with a universe of 15-20 well-established companies yield better returns compared to indirect equity participation via mutual funds, ETFs, etc.

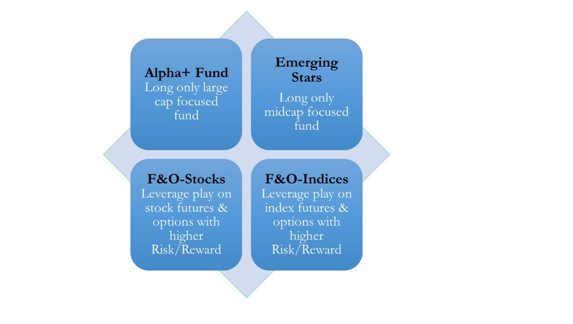

Alpha+ Fund is a non-leveraged long only fund, where we recommend investment ideas in cash with a medium to long term investment horizon. It has a concentrated mix of 14-16 prudently identified businesses across market capitalization. 2/3rd of the portfolio will be purely long term quality stocks and balance 1/3rd will be tactical plays based on earnings’ growth momentum, events, business up-cycle, etc. The fund performance is benchmarked to NIFTY. At SAL, we only offer investment advice and offer a tie-up with Kotak Securities for execution of the same.

Emerging Stars is again a non-leveraged long only fund, that intends to create alpha through allocation in high quality mid-caps and generate superior returns over a medium to long term. We believe a combination of a) Higher earnings growth (18-20% CAGR) and b) Valuation re-rating would generate superior return. We only offer investment advice and offer a tie-up with Kotak Securities for execution of the same.

F & O Stocks is a long short fund with a leverage play (3-5x of capital) to create an Alpha in a portfolio. Here, we play short term events eg. Monthly Auto Data, Results Calendar, RBI Monetary Policy, Corporate Events, etc.Value at Risk (VAR) of any individual trade to be capped at 5-7% of capital. We only offer investment advice and offer a tie-up with Kotak Securities for execution of the same.

F & O Indices While all other features remain the same as F&O- stocks product, here we intend to trade primarily indices – futures and options both and play with higher leverage of 5-8x of capital.Aagin, we only offer investment advice and offer a tie-up with Kotak Securities for execution of the same.

Where you are today is the sum of every choice you’ve ever made. If you don’t like where you are, start making different choices! At SAL, the team leverages its strong market understanding, networking with market stalwarts and other participants in the industry to consistently beat the benchmark returns.

Disclaimer: Senora Advisors and its affiliated company(ies), their directors and employees and their relatives may; from time to time, may have a long or short position in, act as principal in, and buy or sell the securities or derivatives thereof of companies recommended.